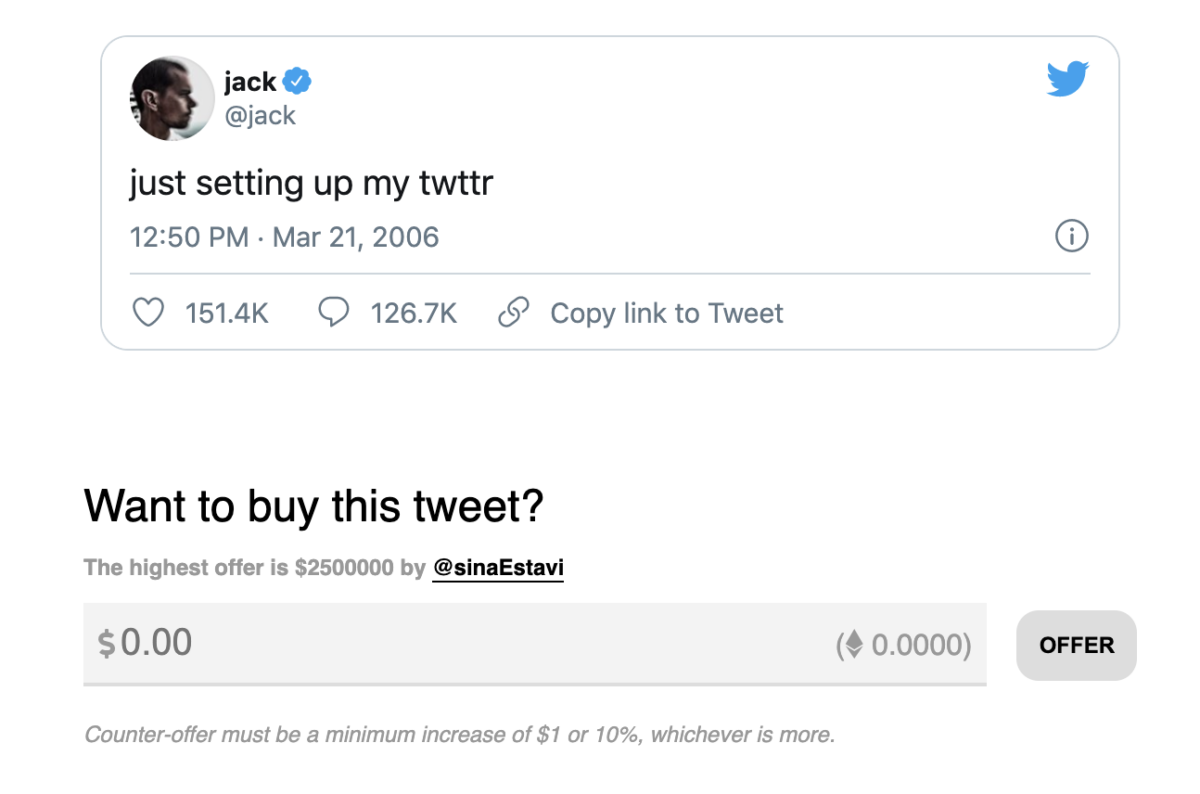

I’ve been hearing a lot of peripheral information about Non-fungible tokens over the past couple of weeks. They often have sensational headlines like Jack Dorsey, Twitter founder, is selling the first tweet as a Non-fungible token and the current bid is at 2.5 Million!

Before you spit out your coffee, let’s go over the basics of Non-fungible tokens (NFTs) and why they are an important asset class for now and the future.

What is an NFT?

An NFT or a Non-fungible token is a cryptographic entity that represents something unique. Fungible means that something is interchangeable, non-fungible means non-interchangeable. For example, if I walked up to a cashier with a $20 bill, I could exchange it for 2 $10 bills, making the currency fungible. A Bitcoin can be exchanged for another as they are also fungible. Something that is non-fungible, like an NFT, cannot be exchanged in this way.

Cryptographic tokens are a type of security token that are utilized to grant access to an electronically restricted resource. Cryptographic tokens utilize cryptography, a technique used to secure communication, to prevent others from reading private information.

NFTs are essentially a type of unique cryptocurrency created on a smart contract platform like Ethereum. Currently, the majority of NFTs are on Ethereum’s blockchain, which cannot be altered over time.

What is Ethereum ?

Ethereum is a decentralized, open-sourced blockchain, that uses a smart-contract functionality. Smart Contract functionality is a transaction protocol which automatically documents legally relevant events/ actions according to the contract’s terms. This reduces the need for: trusted intimidators, enforcement costs, fraud losses, and reduction of malicious and accidental exceptions. Ethereum is the second largest cryptocurrency behind Bitcoin.

As mentioned, the majority of NFTs are created and traded on Ethereum’s blockchain. The NFT’s by nature are unique. Since NFTs are tracked easily, fakes are pointless because each can be traced back to the original owner. NFTs, by nature, cannot be directly exchanged with each other, and are indivisible meaning they exist as a whole item only, unlike a Bitcoin, which you can buy a piece of. They are also verifiable because all of the historical data of ownership is stored on a blockchain, which can be traced back to the original creator, making it possible to authenticate pieces without the need of a third party.

How are NFTs Transforming Digital Assets?

Okay, now that the definitions are out of the way, (phew), you may be wondering…

Why should I care?

Well for starters, NFTs are a safe way for you to own digital things you care about, and great way for artists or internet entrepreneurs to make money.

NFTs also have al lot of uses. According to Ollie Leech at Coindesk, NFTs “represent a wide range of unique tangible and intangible items, from collectible sports cards to virtual real estate and even digital sneakers.”

Yes. Digital sneakers!

Collectors are also using the digital tokens to verify the authenticity of the items. Important in a land of increasing fakes!

According to the Wallstreet Journal, NFTs are allowing people to purchase “provably original versions of everything from digital art to pop albums.” Providing a new way for creators and buyers to sell and acquire unique ownership of digital products.

Kings of Leon, this past Friday, March 5, 2021, was the first band ever to release an album, When You See Yourself, as an NFT. They did multiple listings with different editions and tiers, which you can learn about here.

Don’t worry, the album is also on streaming platforms too.

A bit different from when Wu Tang Clan sold only one copy of Once Upon a Time in Shaolin in 2015… To Martin Shkreli.

Where can you find NFTs?

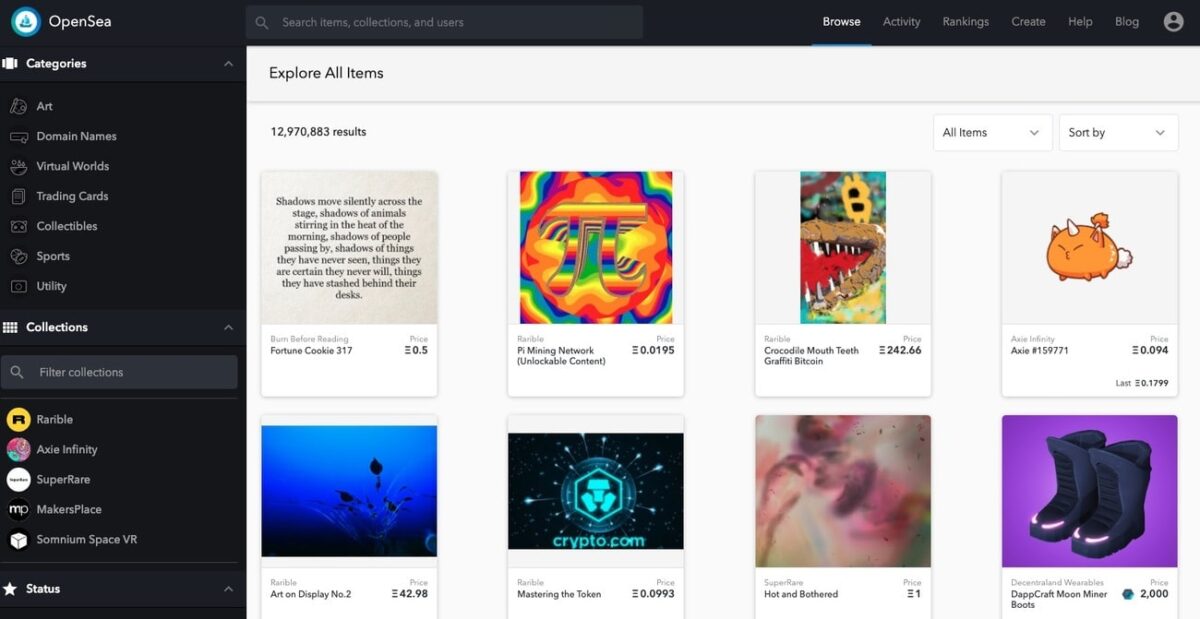

You can find NFTs on platforms such as Nifty Gateway and OpeanSea.

NFTs can be basically anything digital that has value such as art pieces, tweets, videos, digital trading cards, etc. Because it’s the internet, a lot of these items, such as digital artworks or videos can easily be replicated, but there can only be one original or a set of them in a limited supply. Think of this like paintings. There are many replicas of the Mona Lisa, however there is only one original. That being said, like in art, there are also cases where multiples are created and sold. This would be akin to numbered paintings (meaning only 500 sold) or limited edition luxury items.

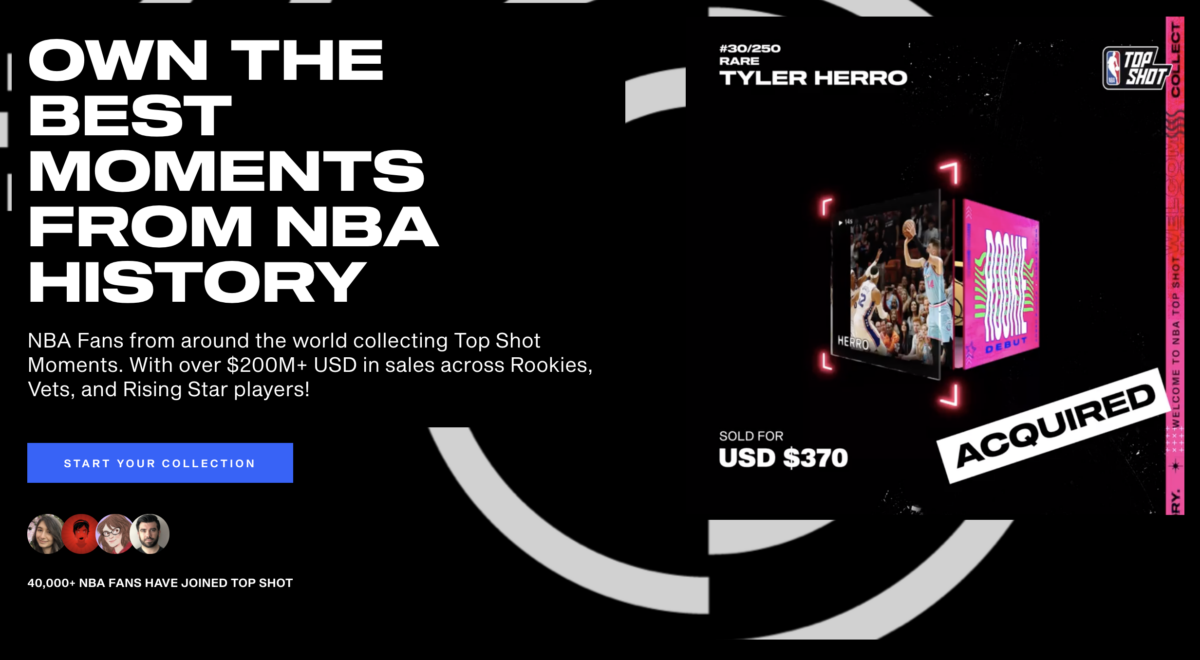

NBA Top Shot

The NBA has always been forward thinking. With the help of Dapper Labs, a consumer focused blockchain product, they figured out a great way to make money from already existing content, through their NFT platform, NBA Top Shot.

NBA Top Shot allows fans to buy NFT video clips of NBA games from their favorite players. A LeBron James slam dunk recently sold for $208,000! These videos aren’t taken offline/off-air or something, they can still be viewed and are still owned by the NBA, but, like a trading card, or in this case a trading video, fans can bid on ownership of the videos and the highest bidder becomes the owner. This allows for fans to “own the best moments from NBA history.”

For more on NBA Top Shot, check out this video of Gary Vaynerchuk explaining the platform on ESPN.

I can see every sports league in the world doing something similar to allow fans to have ownership of relevant highlights. I can also see musicians try this by selling ownership of song lyrics. Could you imagine owning Eminem’s, “His palms are sweaty, knees weak, arms are heavy/

There’s vomit on his sweater already, mom’s spaghetti” from Lose Yourself! Obviously, this is different from catalog ownership, but I could see fans wanting to get in on the action, for bragging rights alone.

Spotlight: Beeple & Grimes

The digital artist Beeple (Mike Winkelmann) has been a huge beneficiary of the NFTs. One of his videos, which initially sold for $67,000 in October 2020, just sold again at the end of February 2021 for 6.6 Million USD.

You can learn more about the transaction here and watch the video on YouTube for free, here.

The premier art auction house Christies, is now auctioning digital artworks by Beeple. Christies is the first major art auction house to offer a purely digital work, and also the first to accept cryptocurrency, Ether, in addition to standard methods of payments.

Musical Artist, Grimes (Claire Elise Boucher), has also sold over 6 Million USD in digital art via NFTs, including short videos set to music and images.

According to Designboom, Grimes sold 10 pieces from her WarNymph digital collection on Nifty Gateway. She created the collection in collaboration with her brother, artist, Mac Boucher. The siblings were able to command such a large sum by selling multiple limited edition copies. The collection drew so much excitement that all the copies were sold in less than 20 minuets!

How Digital Artists are Using NFTs

Why would people pay for art online that they could get for free?

It’s an honest question.

One that I have grappled with personally, when analyzing the continuation/ popularity of NFTs going forward.

This is a new way for artists to get paid, and a way for people to know, with definitive proof, that they own the original piece. Even if the art piece is a JPEG format instead of a physical watercolor painting, to know and have digital proof of ownership of the original piece, one can find tremendous value, for both the owner and the artist. As a buyer, you are paying to own the original. As a seller, this is a new way to make money from art without the physical costs. Giving digital artists the opportunity to make a great profit.

ABC Science’s James Purtill and Paul Donoughue recently wrote about an artist, Serwah Attafuah, who was one of the first Australians to sell an NFT.

She sold Voidwalker (above) for $2,000 and each time the artwork changes hands, she will get 10% of the new sale price. I believe that she will make more money from the piece changing hands, than the original sale.

When talking about NFTs, Serwah said “Paying money for JPEGs kind of blows my mind, but I like it. It’s good.” Read the full article here.

I agree with her. Paying for the original ownership rights to a JPEG a few years ago would sound insane, but it’s happening all the time now, and I see it as a wonderful capitalization opportunity for digital artists.

Nike’s Interesting Authenticity Move

In late 2019, Nike acquired a patent for blockchain based sneakers, called CryptoKicks. Nike will use the technology to help customers keep track of the authenticity of their sneakers. The patent states, “when a consumer buys a genuine pair of shoes, a digital representation of a shoe may be generated, linked with the consumer, and assigned a cryptographic token, where the digital shoe and cryptographic token collectively represent a ‘CryptoKick.'”

I can see other companies, and specifically heavily copied luxury brands, utilizing this system or a similar one to guarantee the authenticity of their products in the future.

Concerns About NFTs and Scary Environmental Impact

I am concerned about NFTs because a lot of the items being sold are available for free online or can be easily copied. Jack Dorsey’s new platform, Valuables is selling NFT Tweets, which anyone can log onto Twitter and see for free. Yes, someone can own the right to the original, but the novelty of that could wear off. That being said, how people spend their money is up to them and if they want to pay a lot for someone else’s tweets, whose’s to say that’s wrong?

What is wrong, or if not wrong, very concerning, is the negative environmental impact that NFTs are generating. NFTs, believe it or not, use a lot of power.

Artist Joanie Lemercier made note of this recently. Lemercier sold 6 of his NFT art pieces on Nifty Gateway for thousands of dollars in 10 seconds. Which he thought was great, until he realized that the sale of the pieces used 8.7 megawatt-hours of energy, the equivalent to the amount of energy he used in his art studio for 2 years. Lemercier made note of this, because as an environmentalist, he didn’t realize the impact of the NFTs and he felt that his effort to be more conscientious blew up in his face in one sale. Check out Wired for more.

I see this as a huge cause for concern when monitoring NFTs going forward. It may be difficult to directly see the impact, but the more we utilize cryptocurrency the worse it may be. According to Cambridge researchers, Bitcoin, uses more energy per year than the entire annual energy consumption of the Netherlands, which is insane!

That being said, according to IEEE Spectrum, Ethereum plans to cut energy consumption by 99%, which would be incredible if possible.

Final Thoughts

While doing research for this article, I asked my friends what they thought about NFTs and many either thought the concept was silly or a bit complex.

I did my best to simplify it here.

While I am not a fortune teller, I do foresee a future where NFTs are far more common. I think more uses will be applied, as we become more comfortable with cryptocurrencies and their seemingly endless applications.

Like any major innovations, there will be problems and skeptics, but I am excited about the value that NFTs provide.

Interesting to see what the future holds.

All the Best,

Ariel Knows Nothing

For More Information Check out the Links Below:

Mashable, NPR, Esquire, Coindesk: explanation on NFTs.

Upgrad: More detailed Cryptography information.

Search Security: security aspects of blockchain and NFTs

Forbes: How businesses are getting in on the NFT action.

Joanie Lemercier‘s personal take on the environmental issues of crypto art.

CNN: How Jack Dorsey is utilizing NFTs

Great content! I do like how you explain different aspects.

There are too many exciting things; art forms around, and the whole concept excites me!

But f I had a chance, Guts Over Fear, ”Do I really belong in this game? I pondered. I just wanna play my part, should I make waves or not?

So back and forth in my brain the tug of war wages on.” would be accurate. Yes, I like that! 🙂

Hi Yagmur!

I’m glad you enjoyed the article!

Guts over fear is everything 🙂